Science and technology have played a critical and publicly visible role in supporting the response to the COVID-19 pandemic, including guiding the public health response, virus suppression, treatment, and testing. It will continue to play a vital role in Australia’s economic recovery and long-term resilience.

The opportunity for a green recovery is highlighted in the recently released CSIRO Critical Energy Minerals Roadmap, which showcases diversification opportunities for Australia to leverage its vast mineral resources and support the global shift towards zero emissions.

What is the current macroeconomic environment?

Global economic environment

- Globally, COVID-19 has 179,241,734 confirmed cases and 3,889,723 confirmed deaths (WHO, 25 June).

- Global economy: Projected to grow 6% in 2021, an upwards revision of the IMF's previous forecast in January due to additional fiscal support in large economies and an anticipated vaccine-driven recovery in the second half of the year (IMF, March 23).

- While the global economy appears to be on firmer ground, significant uncertainty remains regarding whether new virus mutations will prolong the pandemic, the effectiveness of policy actions to limit long-term economic damage, and the divergence of economic recoveries across countries and sectors (IMF, March 23).

- The US: Continues a robust recovery, with GDP growing at an annualised rate of 6.4% in the first quarter of 2021, after a 4.3% increase in the fourth quarter (BEA, 27 May).

- The EU: Continues to struggle, with GDP decreasing by 0.4% in the first quarter of 2021, compared with the previous quarter, following on from falls in the fourth quarter of 2020 (Eurostat, 30 April (pdf · 233KB)).

- China: Continues to expand, growing quarter-over-quarter by 0.6% in the first quarter of 2021, down from 3.2% growth in the fourth quarter of 2020 (South China Morning Post, 16 April).

- Interest rates: Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, and the UK at 0.1%.

Global assistance measures for COVID-19

- Over 2.7 billion doses of vaccine have been given worldwide, although the vaccine rollout has fallen considerably short of achieving equitable global distribution (LSHTM, 25 June).”

- While cases and deaths decline in many areas, the pandemic continues to be an immense challenge in other parts of the world, and the use of public health measures, along with equitable access to medical supplies, oxygen, tests, treatments and vaccines, remain critical (WHO, 1 June).

- Inequitable vaccination access, especially in low-income countries, continues to be a major global issue in the pandemic (WHO, 4 June).

- Policy support varies considerably across countries: Advanced economies have announced sizable fiscal support for 2021, such as the US’s 1.9 trillion USD relief bill and the European Union’s 750 billion euro Next Generation EU program, which are expected to strongly boost growth (IMF, March 23).

- However, fiscal support in emerging market and developing economies has been more limited and higher debt service costs are expected to constrain their ability to address social needs, including rising poverty and growing inequality (IMF, March 23).

- Globally, there are currently 184 COVID-19 vaccines in pre-clinical development, along with 103 in clinical development (WHO, 22 June).”

- For a comprehensive and recent global policy response tracker, see IMF, 30 June.

Australian economic environment and assistance measures

- 30,408 confirmed COVID-19 cases and 910 confirmed deaths (Department of Health, 25 June). Further, approximately 7 million COVID-19 vaccine doses have been given in Australia so far (Department of Health, 23 June).

- State and territory governments continue to impose different restrictions. In Victoria, an outbreak in late May resulted in a return to heightened lockdown restrictions. The lockdown and restrictions have since eased.

- A temporary COVID Disaster payment of up to $500 per week has been made available to eligible workers affected due to state lockdowns (Prime Minister, 3 June).

- GDP rose 1.8% in the first quarter of 2021, compared to the previous quarter, reflecting the continued easing of COVID-19 restrictions and the recovery in the labour market. With the latest growth figures, Australian economic activity has returned to above pre-pandemic levels. (ABS, 2 June).

- The unemployment rate fell 0.4 percentage points (pts) to 5.1% from April to May, which is the seventh monthly consecutive fall in the unemployment rate, down from 6.9% in October 2020 (ABS, 17 June).

- The youth unemployment rate increased 0.1 pts to 10.7% (ABS, 17 June).

- Business conditions are stable, with 78% of businesses having reported either no change or increased revenue in May, which is unchanged from the previous month. Since the end of March, 20% of businesses have stopped accessing support measures such as wage subsidies and deferred loan payments (ABS, 27 May).

- The RBA interest rate remains at a historic low of 0.1%.

The Australian Federal Budget

The 2021-22 Federal Budget was delivered on 11 May. According to the Budget, net debt is expected to reach $729 billion (or 34.2% of GDP) in 2021-22 and peak at $980.6 billion (or 40.9% of GDP) in mid-2025. The government have stated that this is designed to be a service-focused budget, with major items focused on areas such as child care and aged care. These include:

- An additional $17.7 billion toward aged care.

- An additional $2.3 billion into the National Mental Health and Suicide Prevention Plan.

- An additional $1.7 billion to child care.

- $1.1 billion into women’s safety measures.

In terms of R&D related items, this Budget included:

- An $1.2 billion investment into the Digital Economy Strategy, including investments into AI technologies.

- $1.6 billion in funding over 10 years to incentivise private investment in technologies identified in the Government's Technology Investment Roadmap and Low Emissions Technology Statements.

- A $850.4 million investment for the Agriculture 2030 package of measures to support the sector in reaching farm gate output of $100 billion by 2030.

- $387 million in new funding over 10 years for the construction and operations of the Square Kilometre Array radio telescope in Western Australia.

- The introduction of a patent box tax regime to encourage medical and biotech innovation by taxing corporate income derived from those patents at a concessional rate of 17% starting July 1, 2022.

Economics is driving the energy transition opportunities for Australia’s mining and manufacturing sectors

Expected and observed economic impacts of Australia’s critical energy minerals:

- High value exports from critical energy minerals provide an important source of economic growth for Australia.

- Resources comprise 66% of Australia’s total product exports and manufacturing comprises 8% (RBA, 2021). Critical energy minerals represent an opportunity for Australia to optimise the connection between its mining, manufacturing, and energy sectors, and diversify its export base by adding value through the manufacture of more complex products.

- Australia produced 56% (45 kt) of global lithium, 5% (938 kt) of global copper, and 4% (6 kt) of global cobalt in 2019 (Geoscience Australia, 2021).

- Australia is currently the fourth largest producer of rare earth elements (REE) with 9% global market share in 2020, behind China, the US, and Myanmar (OCE, 2021 (PDF · 9.4MB)).

- Given that the mining sector already represents 10% of Australia’s total energy use (ARENA, 2017 (PDF · 7.6MB)), mining for critical energy minerals can accelerate low-cost renewable energy.

Growing our critical energy minerals sector and connecting mining with manufacturing:

- Many renewable energy technologies key to the energy transition are yet to hit a ‘tipping point’ which creates considerable scope for investment in new regions.

- Opportunities lie in the production of high purity materials required for high-growth renewable energy technologies, namely solar photovoltaics, wind, concentrated solar power, batteries, and hydrogen.

- Global electric vehicle fleet size is projected to increase 30% a year to 2050, while global stationary battery storage and wind capacity are projected to increase to 8% and 6% a year respectively to 2050 (OCE, 2021 (PDF · 9.4MB)).

- Along with Australia’s critical energy mineral endowment, its access to solar and wind, land, skilled workforce, and R&D capabilities provide the potential for Australia to be a world-leader in low cost renewable energy.

- CSIRO’s Critical Energy Minerals Roadmap emphasises that investment priorities to realise these opportunities must be considered from commercial, regulatory and policy, and RD&D perspectives.

The global transition to renewable energy will be underpinned by technologies that require a broad range of critical minerals.

Australia’s future recovery and resilience

- In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while supporting vaccine deployment and related science.

- In the medium term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery. Medium-term recovery opportunities involve deployment-ready technologies that could have positive economic impacts.

- In the long term, focus should shift to building a resilient economy and reducing Australia’s exposure to future shocks. Long-term resilience involves technologies that are often still in development and demand further investment, technical and commercial testing, and scale-up before their economic potential is fully realisable.

Disclaimer

This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.

Science and technology have played a critical and publicly visible role in supporting the response to the COVID-19 pandemic, including guiding the public health response, virus suppression, treatment, and testing. It will continue to play a vital role in Australia’s economic recovery and long-term resilience.

The opportunity for a green recovery is highlighted in the recently released CSIRO Critical Energy Minerals Roadmap, which showcases diversification opportunities for Australia to leverage its vast mineral resources and support the global shift towards zero emissions.

What is the current macroeconomic environment?

Global economic environment

- Globally, COVID-19 has 179,241,734 confirmed cases and 3,889,723 confirmed deaths (WHO, 25 June).

- Global economy: Projected to grow 6% in 2021, an upwards revision of the IMF's previous forecast in January due to additional fiscal support in large economies and an anticipated vaccine-driven recovery in the second half of the year (IMF, March 23).

- While the global economy appears to be on firmer ground, significant uncertainty remains regarding whether new virus mutations will prolong the pandemic, the effectiveness of policy actions to limit long-term economic damage, and the divergence of economic recoveries across countries and sectors (IMF, March 23).

- The US: Continues a robust recovery, with GDP growing at an annualised rate of 6.4% in the first quarter of 2021, after a 4.3% increase in the fourth quarter (BEA, 27 May).

- The EU: Continues to struggle, with GDP decreasing by 0.4% in the first quarter of 2021, compared with the previous quarter, following on from falls in the fourth quarter of 2020 (Eurostat, 30 April (pdf · 233KB)).

- China: Continues to expand, growing quarter-over-quarter by 0.6% in the first quarter of 2021, down from 3.2% growth in the fourth quarter of 2020 (South China Morning Post, 16 April).

- Interest rates: Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, and the UK at 0.1%.

Global assistance measures for COVID-19

- Over 2.7 billion doses of vaccine have been given worldwide, although the vaccine rollout has fallen considerably short of achieving equitable global distribution (LSHTM, 25 June).”

- While cases and deaths decline in many areas, the pandemic continues to be an immense challenge in other parts of the world, and the use of public health measures, along with equitable access to medical supplies, oxygen, tests, treatments and vaccines, remain critical (WHO, 1 June).

- Inequitable vaccination access, especially in low-income countries, continues to be a major global issue in the pandemic (WHO, 4 June).

- Policy support varies considerably across countries: Advanced economies have announced sizable fiscal support for 2021, such as the US’s 1.9 trillion USD relief bill and the European Union’s 750 billion euro Next Generation EU program, which are expected to strongly boost growth (IMF, March 23).

- However, fiscal support in emerging market and developing economies has been more limited and higher debt service costs are expected to constrain their ability to address social needs, including rising poverty and growing inequality (IMF, March 23).

- Globally, there are currently 184 COVID-19 vaccines in pre-clinical development, along with 103 in clinical development (WHO, 22 June).”

- For a comprehensive and recent global policy response tracker, see IMF, 30 June.

Australian economic environment and assistance measures

- 30,408 confirmed COVID-19 cases and 910 confirmed deaths (Department of Health, 25 June). Further, approximately 7 million COVID-19 vaccine doses have been given in Australia so far (Department of Health, 23 June).

- State and territory governments continue to impose different restrictions. In Victoria, an outbreak in late May resulted in a return to heightened lockdown restrictions. The lockdown and restrictions have since eased.

- A temporary COVID Disaster payment of up to $500 per week has been made available to eligible workers affected due to state lockdowns (Prime Minister, 3 June).

- GDP rose 1.8% in the first quarter of 2021, compared to the previous quarter, reflecting the continued easing of COVID-19 restrictions and the recovery in the labour market. With the latest growth figures, Australian economic activity has returned to above pre-pandemic levels. (ABS, 2 June).

- The unemployment rate fell 0.4 percentage points (pts) to 5.1% from April to May, which is the seventh monthly consecutive fall in the unemployment rate, down from 6.9% in October 2020 (ABS, 17 June).

- The youth unemployment rate increased 0.1 pts to 10.7% (ABS, 17 June).

- Business conditions are stable, with 78% of businesses having reported either no change or increased revenue in May, which is unchanged from the previous month. Since the end of March, 20% of businesses have stopped accessing support measures such as wage subsidies and deferred loan payments (ABS, 27 May).

- The RBA interest rate remains at a historic low of 0.1%.

The Australian Federal Budget

The 2021-22 Federal Budget was delivered on 11 May. According to the Budget, net debt is expected to reach $729 billion (or 34.2% of GDP) in 2021-22 and peak at $980.6 billion (or 40.9% of GDP) in mid-2025. The government have stated that this is designed to be a service-focused budget, with major items focused on areas such as child care and aged care. These include:

- An additional $17.7 billion toward aged care.

- An additional $2.3 billion into the National Mental Health and Suicide Prevention Plan.

- An additional $1.7 billion to child care.

- $1.1 billion into women’s safety measures.

In terms of R&D related items, this Budget included:

- An $1.2 billion investment into the Digital Economy Strategy, including investments into AI technologies.

- $1.6 billion in funding over 10 years to incentivise private investment in technologies identified in the Government's Technology Investment Roadmap and Low Emissions Technology Statements.

- A $850.4 million investment for the Agriculture 2030 package of measures to support the sector in reaching farm gate output of $100 billion by 2030.

- $387 million in new funding over 10 years for the construction and operations of the Square Kilometre Array radio telescope in Western Australia.

- The introduction of a patent box tax regime to encourage medical and biotech innovation by taxing corporate income derived from those patents at a concessional rate of 17% starting July 1, 2022.

Economics is driving the energy transition opportunities for Australia’s mining and manufacturing sectors

Expected and observed economic impacts of Australia’s critical energy minerals:

- High value exports from critical energy minerals provide an important source of economic growth for Australia.

- Resources comprise 66% of Australia’s total product exports and manufacturing comprises 8% (RBA, 2021). Critical energy minerals represent an opportunity for Australia to optimise the connection between its mining, manufacturing, and energy sectors, and diversify its export base by adding value through the manufacture of more complex products.

- Australia produced 56% (45 kt) of global lithium, 5% (938 kt) of global copper, and 4% (6 kt) of global cobalt in 2019 (Geoscience Australia, 2021).

- Australia is currently the fourth largest producer of rare earth elements (REE) with 9% global market share in 2020, behind China, the US, and Myanmar (OCE, 2021 (PDF · 9.4MB)).

- Given that the mining sector already represents 10% of Australia’s total energy use (ARENA, 2017 (PDF · 7.6MB)), mining for critical energy minerals can accelerate low-cost renewable energy.

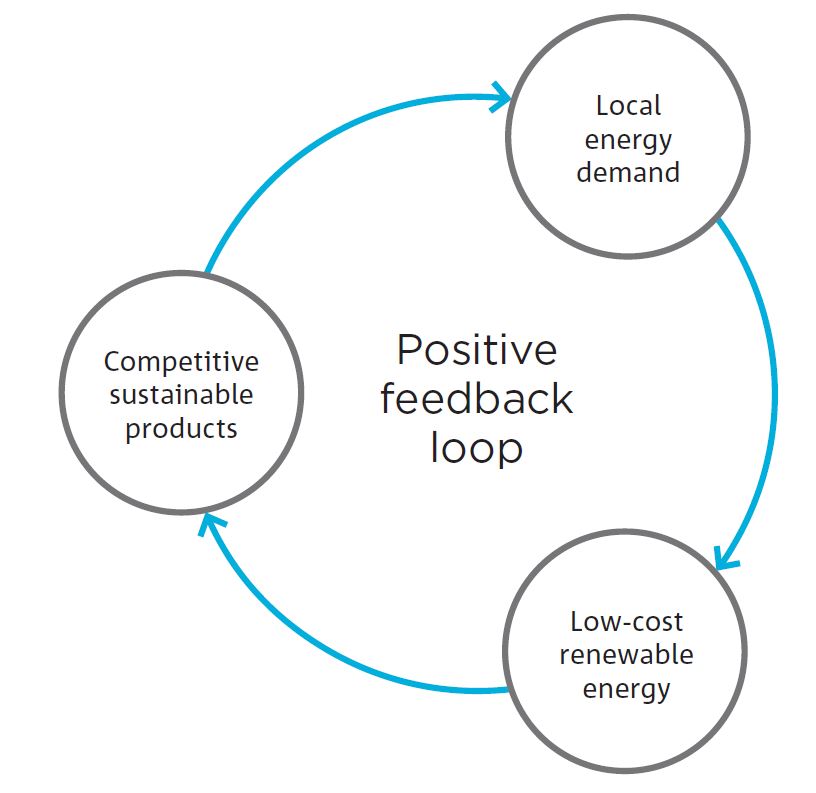

Graphic from Critical Energy Minerals Roadmap showing positive feedback loop. Three components of the feedback loop are, local energy demand, low cost renewable energy, competitive sustainable products.

Growing our critical energy minerals sector and connecting mining with manufacturing:

- Many renewable energy technologies key to the energy transition are yet to hit a ‘tipping point’ which creates considerable scope for investment in new regions.

- Opportunities lie in the production of high purity materials required for high-growth renewable energy technologies, namely solar photovoltaics, wind, concentrated solar power, batteries, and hydrogen.

- Global electric vehicle fleet size is projected to increase 30% a year to 2050, while global stationary battery storage and wind capacity are projected to increase to 8% and 6% a year respectively to 2050 (OCE, 2021 (PDF · 9.4MB)).

- Along with Australia’s critical energy mineral endowment, its access to solar and wind, land, skilled workforce, and R&D capabilities provide the potential for Australia to be a world-leader in low cost renewable energy.

- CSIRO’s Critical Energy Minerals Roadmap emphasises that investment priorities to realise these opportunities must be considered from commercial, regulatory and policy, and RD&D perspectives.

The global transition to renewable energy will be underpinned by technologies that require a broad range of critical minerals.

Australia’s future recovery and resilience

- In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while supporting vaccine deployment and related science.

- In the medium term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery. Medium-term recovery opportunities involve deployment-ready technologies that could have positive economic impacts.

- In the long term, focus should shift to building a resilient economy and reducing Australia’s exposure to future shocks. Long-term resilience involves technologies that are often still in development and demand further investment, technical and commercial testing, and scale-up before their economic potential is fully realisable.

Disclaimer

This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.