Science and technology continue to play a critical role in supporting the global response to COVID-19 and will continue to support Australia’s economic recovery and long-term resilience.

The opportunity for large Australian companies to achieve greater commercial outputs from science and technology is explored in CSIRO’s recent Unlocking the innovation potential of Australia companies report. CSIRO also recently released a working paper which quantifies Australia’s returns to innovation.

Innovative science and technology drive economic growth in Australia

CSIRO Futures has estimated the economy-wide return on investment for R&D spending in Australia. The results state that $1 of R&D investment creates an average of $3.50 in economy-wide benefits in today’s dollars, and a 10% average annual return for Australia.

In contrast, Australia’s ten-year government bond returns have historically averaged around 7% annually and investments in the ASX200 stock index have typically yielded around 10% annually.

These findings demonstrate that the economy-wide returns to innovation are high and imply that Australia could capture substantial returns from additional investment in science and technology R&D.

What is the current macroeconomic environment?

Global economic environment

- Global economy: Projected to grow 5.9% in 2021 and 4.9% in 2022, with a downward revision for 2021 by 0.1 percentage points (pts). This revision reflects supply disruptions in advanced economies and worsening pandemic dynamics in low-income developing countries. The rapid spread of Delta and the threat of new variants is also increasing uncertainty (IMF, 12 October).

- Inflation has increased markedly in the US and some emerging market economies, due to accelerated demand but a slower supply response as restrictions ease. Despite concerns, price pressures are expected to subside in most countries in 2022 (IMF, 12 October).

- Global labour market recovery has stalled during 2021, with little progress being made since the fourth quarter of 2020, and working hours in 2021 estimated to be 4.5% below pre-pandemic levels. Working hours in high- and upper-middle-income countries tended to recover in 2021, while lower-middle and low-income countries continued to suffer losses (ILO, 27 October).

- The US: GDP increased 0.5% in the third quarter of 2021, after a 1.6% increase in the second quarter (FRED, 28 October).

- The EU: GDP increased 2.1% in the third quarter of 2021, compared with a 2.0% increase in the second quarter (Eurostat, 29 October).

- China: GDP grew quarter-over-quarter by 0.2% in the third quarter of 2021 (Reuters, 18 October).

- Interest rates: Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, and the UK at 0.1%.

Global macroeconomic assistance measures

- 8.3 billion COVID-19 vaccine doses have been given worldwide, although the rollout has fallen considerably short of achieving equitable global distribution (LSHTM, 16 December).

- Touted as a ‘once-in-a-generation’ investment in infrastructure, the US signed into law the US$1.2 trillion Infrastructure Investment and Jobs Act on November 15, which includes US$550 billion in new funding to rebuild infrastructure including for water, internet, roads and bridges (White House, 6 November).

- All in all, large fiscal packages announced or approved by the EU and US could add US$4.6 trillion in total to global GDP between 2021 and 2026. Additional measures are expected in the forthcoming 2022 national budgets for other advanced economies (IMF, 13 October).

- A comprehensive and recent global policy response tracker to COVID-19.

Australian economic environment and COVID-19 assistance measures

- GDP fell 1.9% in the third quarter of 2021, driven by falls in household spending due to prolonged lockdowns across NSW, VIC and the ACT. (ABS, 1 December).

- The RBA expects GDP to grow 3% over 2021 and 5.5% over 2022. Further, inflation has picked up but is still low in underlying terms, with CPI inflation affected by higher petrol prices, higher newly constructed home prices and global supply chains disruptions (RBA, 2 November).

- The unemployment rate fell 0.6 pts to 4.6% from October to November and the participation rate increased 1.4 pts to 66.1%, with the easing of restrictions in both NSW and VIC having a significant influence on the labour market figures (ABS, 16 December).

- The youth unemployment rate decreased by 2.2 pts to 10.9% from October to November. Further, hours worked increased in November and the underemployment rate fell 2.0 pts to 7.5%. (ABS, 16 December).

- A $1 billion technology fund has been announced for Australian companies to develop new low emissions technology (Prime Minister, 10 November).

- $33 million in funding has been provided to Australian food and beverage companies as part of the latest round of the $1.3 Modern Manufacturing Initiative (Prime Minister, 12 November).

- $111 million in funding has been provided to develop Australia’s quantum technology sector, including in a Quantum Commercialisation Hub to foster partnerships, commercialise research, and help businesses access new markets and investors (Prime Minister, 17 November).

- The Trailblazer Program was recently announced and is intended to support universities to boost prioritised R&D and drive commercialisation outcomes with industry partners. This includes $30 million for participating universities to partner with CSIRO and access specialist equipment (Department of Education Skills and Employment, 24 November).

- The RBA interest rate remains at a historic low of 0.1%.

How might innovation matter for Australian companies and for the economy in general?

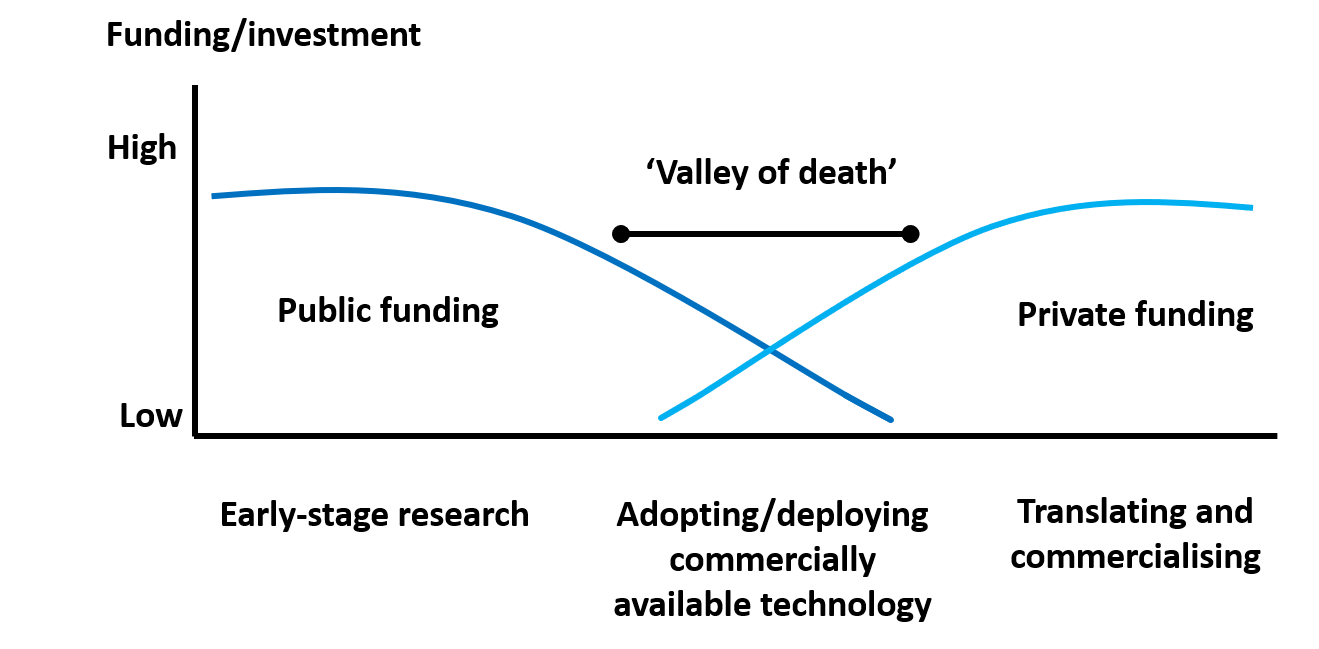

One of Australia’s greatest innovation challenges lies at the research-industry nexus: translating research into scalable, commercial outcomes.

The recently released Unlocking the innovation potential of Australia companies report highlights practical steps large Australian companies can take to achieve greater commercial outputs from science and technology.

Challenges facing the Australian economy:

Leading up to the pandemic, there were concerning trends in Australia’s economic fundamentals such as low productivity, low business investment, and stagnation in several industries (e.g., traditional large-scale manufacturing).

It was also experiencing low levels of cross-sector collaboration and a cultural aversion to risk-taking, both of which are essential to innovating.

Expected economic impacts of unlocking Australia’s innovation potential:

If Australia takes decisive action now, it can become a future-looking, resilient and advanced economy that:

- Continues to leverage its existing strengths but also diversifies its industrial base

- Continues to invest in innovation

- Progresses existing and new industries by embracing emerging technologies

- Capitalises on opportunities to integrate itself into high-value global supply chains

- Progresses towards reaching net-zero emissions by 2050

- Focuses on commercialising technology and scaling it through new company creation

- Trains workforces with the necessary skills for the technologies of the future.

Enablers for companies to improve science and technology commercialisation:

Drawing on insights from business leaders in Australia's largest companies, the report identifies the following effective strategies to overcome commercialisation challenges:

- Collaborate widely with research, government, and industry

- Have clear, long term innovation strategies and targeted investments

- Embrace a culture of innovation, risk sharing and incentives alignment

- Invest in skills, talent, and capability building.

While not all innovations challenges can be overcome by companies alone - and instead also require action on the part of government and research – the report identifies practical actions that Australian companies can take to overcome some of the barriers to commercialisation.

Australia’s future recovery and resilience

- In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while supporting vaccine deployment and related science.

- In the medium term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery. Medium-term recovery opportunities involve deployment-ready technologies that could have positive economic impacts.

- In the long term, focus should shift to building a resilient economy and reducing Australia’s exposure to future shocks. Long-term resilience involves technologies that are often still in development and demand further investment, technical and commercial testing, and scale-up before their economic potential is fully realisable.

Disclaimer

This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.

Science and technology continue to play a critical role in supporting the global response to COVID-19 and will continue to support Australia’s economic recovery and long-term resilience.

The opportunity for large Australian companies to achieve greater commercial outputs from science and technology is explored in CSIRO’s recent Unlocking the innovation potential of Australia companies report. CSIRO also recently released a working paper which quantifies Australia’s returns to innovation.

Innovative science and technology drive economic growth in Australia

CSIRO Futures has estimated the economy-wide return on investment for R&D spending in Australia. The results state that $1 of R&D investment creates an average of $3.50 in economy-wide benefits in today’s dollars, and a 10% average annual return for Australia.

In contrast, Australia’s ten-year government bond returns have historically averaged around 7% annually and investments in the ASX200 stock index have typically yielded around 10% annually.

These findings demonstrate that the economy-wide returns to innovation are high and imply that Australia could capture substantial returns from additional investment in science and technology R&D.

What is the current macroeconomic environment?

Global economic environment

- Global economy: Projected to grow 5.9% in 2021 and 4.9% in 2022, with a downward revision for 2021 by 0.1 percentage points (pts). This revision reflects supply disruptions in advanced economies and worsening pandemic dynamics in low-income developing countries. The rapid spread of Delta and the threat of new variants is also increasing uncertainty (IMF, 12 October).

- Inflation has increased markedly in the US and some emerging market economies, due to accelerated demand but a slower supply response as restrictions ease. Despite concerns, price pressures are expected to subside in most countries in 2022 (IMF, 12 October).

- Global labour market recovery has stalled during 2021, with little progress being made since the fourth quarter of 2020, and working hours in 2021 estimated to be 4.5% below pre-pandemic levels. Working hours in high- and upper-middle-income countries tended to recover in 2021, while lower-middle and low-income countries continued to suffer losses (ILO, 27 October).

- The US: GDP increased 0.5% in the third quarter of 2021, after a 1.6% increase in the second quarter (FRED, 28 October).

- The EU: GDP increased 2.1% in the third quarter of 2021, compared with a 2.0% increase in the second quarter (Eurostat, 29 October).

- China: GDP grew quarter-over-quarter by 0.2% in the third quarter of 2021 (Reuters, 18 October).

- Interest rates: Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, and the UK at 0.1%.

Global macroeconomic assistance measures

- 8.3 billion COVID-19 vaccine doses have been given worldwide, although the rollout has fallen considerably short of achieving equitable global distribution (LSHTM, 16 December).

- Touted as a ‘once-in-a-generation’ investment in infrastructure, the US signed into law the US$1.2 trillion Infrastructure Investment and Jobs Act on November 15, which includes US$550 billion in new funding to rebuild infrastructure including for water, internet, roads and bridges (White House, 6 November).

- All in all, large fiscal packages announced or approved by the EU and US could add US$4.6 trillion in total to global GDP between 2021 and 2026. Additional measures are expected in the forthcoming 2022 national budgets for other advanced economies (IMF, 13 October).

- A comprehensive and recent global policy response tracker to COVID-19.

Australian economic environment and COVID-19 assistance measures

- GDP fell 1.9% in the third quarter of 2021, driven by falls in household spending due to prolonged lockdowns across NSW, VIC and the ACT. (ABS, 1 December).

- The RBA expects GDP to grow 3% over 2021 and 5.5% over 2022. Further, inflation has picked up but is still low in underlying terms, with CPI inflation affected by higher petrol prices, higher newly constructed home prices and global supply chains disruptions (RBA, 2 November).

- The unemployment rate fell 0.6 pts to 4.6% from October to November and the participation rate increased 1.4 pts to 66.1%, with the easing of restrictions in both NSW and VIC having a significant influence on the labour market figures (ABS, 16 December).

- The youth unemployment rate decreased by 2.2 pts to 10.9% from October to November. Further, hours worked increased in November and the underemployment rate fell 2.0 pts to 7.5%. (ABS, 16 December).

- A $1 billion technology fund has been announced for Australian companies to develop new low emissions technology (Prime Minister, 10 November).

- $33 million in funding has been provided to Australian food and beverage companies as part of the latest round of the $1.3 Modern Manufacturing Initiative (Prime Minister, 12 November).

- $111 million in funding has been provided to develop Australia’s quantum technology sector, including in a Quantum Commercialisation Hub to foster partnerships, commercialise research, and help businesses access new markets and investors (Prime Minister, 17 November).

- The Trailblazer Program was recently announced and is intended to support universities to boost prioritised R&D and drive commercialisation outcomes with industry partners. This includes $30 million for participating universities to partner with CSIRO and access specialist equipment (Department of Education Skills and Employment, 24 November).

- The RBA interest rate remains at a historic low of 0.1%.

How might innovation matter for Australian companies and for the economy in general?

One of Australia’s greatest innovation challenges lies at the research-industry nexus: translating research into scalable, commercial outcomes.

The recently released Unlocking the innovation potential of Australia companies report highlights practical steps large Australian companies can take to achieve greater commercial outputs from science and technology.

Challenges facing the Australian economy:

Leading up to the pandemic, there were concerning trends in Australia’s economic fundamentals such as low productivity, low business investment, and stagnation in several industries (e.g., traditional large-scale manufacturing).

It was also experiencing low levels of cross-sector collaboration and a cultural aversion to risk-taking, both of which are essential to innovating.

Expected economic impacts of unlocking Australia’s innovation potential:

If Australia takes decisive action now, it can become a future-looking, resilient and advanced economy that:

- Continues to leverage its existing strengths but also diversifies its industrial base

- Continues to invest in innovation

- Progresses existing and new industries by embracing emerging technologies

- Capitalises on opportunities to integrate itself into high-value global supply chains

- Progresses towards reaching net-zero emissions by 2050

- Focuses on commercialising technology and scaling it through new company creation

- Trains workforces with the necessary skills for the technologies of the future.

Enablers for companies to improve science and technology commercialisation:

Drawing on insights from business leaders in Australia's largest companies, the report identifies the following effective strategies to overcome commercialisation challenges:

- Collaborate widely with research, government, and industry

- Have clear, long term innovation strategies and targeted investments

- Embrace a culture of innovation, risk sharing and incentives alignment

- Invest in skills, talent, and capability building.

While not all innovations challenges can be overcome by companies alone - and instead also require action on the part of government and research – the report identifies practical actions that Australian companies can take to overcome some of the barriers to commercialisation.

Australia’s future recovery and resilience

- In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while supporting vaccine deployment and related science.

- In the medium term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery. Medium-term recovery opportunities involve deployment-ready technologies that could have positive economic impacts.

- In the long term, focus should shift to building a resilient economy and reducing Australia’s exposure to future shocks. Long-term resilience involves technologies that are often still in development and demand further investment, technical and commercial testing, and scale-up before their economic potential is fully realisable.

Disclaimer

This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.