What is the current macroeconomic environment?

Global economic environment and assistance measures

- COVID-19 is in 216 countries/territories with 25,884,895 confirmed cases and 859,130 confirmed deaths (WHO, 4 September).

- The pandemic has caused a major decline in trade, lower commodity prices and tighter external financing conditions. IMF analysis warns that additional global finance stress could raise risks of contagion, economic scarring and trade tensions. This is particularly the case for economies with pre-existing vulnerabilities, such as those reliant on oil, tourism or remittances, with large current account deficits, high foreign currency debt and limited international reserves (IMF, 4 August).

- Travel restrictions and border closures have greatly affected goods and services trade. For example, global air cargo capacity shrank by 24.6% in March 2020. By the end of April, at least 74 economies had introduced export prohibitions, licences or controls, mostly focussed on medical goods (WTO, 12 August).

- To recap, GDP in the US decreased 9.5% in the second quarter compared with the first (BEA, 30 July) and GDP decreased 11.7% in the EU in the second quarter compared with the first (Eurostat, 14 August).

- Japan's economy shrank 7.8% in the second quarter, its sharpest contraction on record (The Japan Times, 17 August) and the UK economy fell 20.4% quarter on quarter (ONS, 12 August), the largest decline of any major European economy.

Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, the UK at 0.1%.

Despite a growing number of cases, there are signs that countries are now much better prepared to respond to COVID-19, with most countries now having preparedness and response plans and risk communication and community engagement plans in place (WHO, 20 August). However, several countries are experiencing fresh outbreaks after periods of little or no transmission. (WHO, 21 August).

The WHO lists 31 COVID-19 candidate vaccines in clinical evaluation, with another 142 candidate vaccines in preclinical evaluation (WHO, 25 August).

For a comprehensive and current policy response tracker, see IMF, 4 September.

Australian economic environment and assistance measures

26,049 confirmed cases and 678 confirmed deaths (Department of Health, 4 September).

- GDP fell 7.0% in the June quarter, after a fall of 0.3% in the March quarter 2020 (ABS, 2 September). With two consecutive quarters of negative growth, Australia has entered its first technical recession in 29 years.

- State and territory governments continue to impose different restrictions. In Victoria, a COVID-19 outbreak has triggered Stage 4 stay-at-home restrictions for Metropolitan Melbourne with strong restrictions also applied throughout the rest of the state.

- From June to July, the unemployment rate increased by less than 0.1 percentage points to 7.5%. Seasonally adjusted employment increased by 114,700 people and hours worked increased by 1.3% (ABS, 13 August).

- Considering those who have lost employment, left the labour force or have experienced zero working hours, the effective unemployment rate is around 9.9% (Treasurer, 24 August). This is a fall from the peak in April when it reached almost 15% (Treasury, 30 July).

- Retail turnover rose 3.3% in July 2020 from the previous month. Retail turnover rose in all states and territories except Victoria in July (ABS, 21 August).

- Total capital expenditure by private businesses fell -5.9% in the June quarter following a fall of -2.1% in the March quarter (ABS, 27 August).

- Following new restrictions in Victoria, the Government has expanded business access for the JobKeeper extension. This is expected to increase the total cost of the program to $101.3 billion (Treasurer, 7 August).

- The Government will increase aged care support programs with an additional $171.5 million as part of a new COVID-19 response plan agreed by all states and territories (Prime Minister, 21 August).

- The Government has announced a $1 billion investment package to support Australia’s defence industry as part of its COVID-19 economic recovery plans (Prime Minister, 26 August).

The Australian interest rate remains at 0.25%.

How might macroeconomics impact the Australian manufacturing sector?

Manufacturing is a significant contributor to the Australian economy, processing raw materials, supplying intermediate inputs to other sectors, and producing final goods.

In 2019, the sector had a Gross Value Added of $26.1 billion (almost 5.5% of GDP) and employed 890,500 workers. Manufacturing exports totalled $127.1 billion that year.

Expected and observed impacts on the sector

New capital expenditure fell -4.5% for the manufacturing sector in the June quarter, reflecting contractions in new private capital investment caused by country-wide restrictions and record-low business confidence (ABS, 27 August).

Reflecting the ongoing contraction of the economy, the sale of manufacturing goods and services fell 8.6% in the June quarter. Similarly, wages and salaries for the sector fell 3.9% (ABS, 31 August).

In contrast, and reflecting a broader rise in gross company profits, manufacturing company gross operating profits rose 8.4% in the June quarter (ABS, 31 August). This result is largely due to the impact of subsidies.

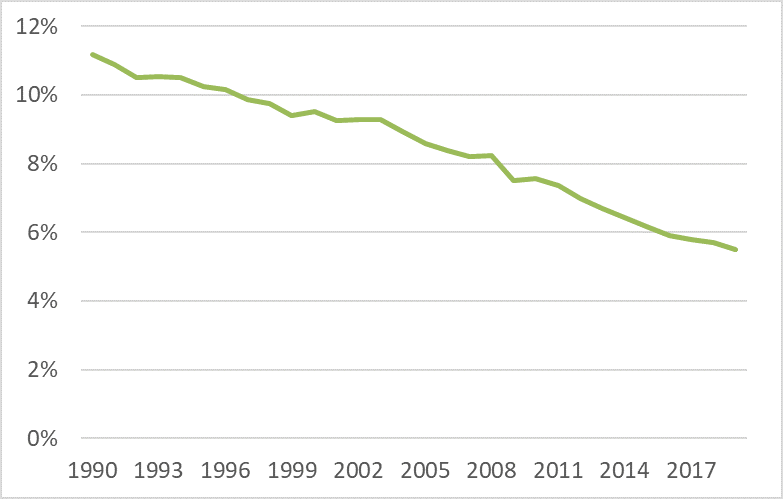

Manufacturing has been consistently declining as a proportion of the economy (Figure 1.1). This is indicative of a multi-decadal decline for the sector, driven by numerous factors including growth in services, outsourcing and import competition (Productivity Commission, 2003).

Supply chain vulnerabilities and dependencies on overseas manufactured products have been exposed and are being examined (ABC News, 8 June). The Federal Government has stated it is committed to bolstering the local manufacturing sector to secure economic sovereignty (Minister for Industry, Science and Technology, 20 May). One role of the National COVID-19 Commission Advisory Board (NCC) has been to solve immediate supply chain priorities with manufacturers to provide essential products (NCC, 3 April).

However, there has also been much interest in the pivot made by local manufacturing companies to provide essential medical supplies, such as ventilators and PPE, during the initial months of the pandemic in Australia (ABC News, 29 April).

The NCC’s manufacturing taskforce has identified eight industries for growth: food manufacturing, mining technology, defence, renewable energy, healthcare and biotechnology, recycling and packaging, advance manufacturing and aerospace. The taskforce estimates that manufacturing could potentially create

495,000 new jobs in the next decade (SMH, 29 July).

Other commentators have made the case for a 'green recovery', with an accelerated shift to net-zero emissions, led partly by investment in clean-technology exports industries, such as local manufacture of wind turbine and battery components (AFR, 12 August, ABC News, 7 June; The Guardian, 29 June).

CSIRO has launched a missions-led strategy to solve some of Australia's most significant challenges. The agency plans to direct $100 million annually to the co-creation of various missions with government, universities, industry and community partners. Listed among CSIRO's co-creation opportunities are the development of agile manufacturing for higher revenue and sovereign supply, as well as the creation of a hydrogen industry to generate clean energy exports.

Innovation in the sector

The effects of COVID-19 have renewed interest in the sector, highlighting the importance of local manufacturing in times of supply chain fragility and soaring global demand. Innovative manufacturing can generate economic growth opportunities in the medium-term and equip the nation to better respond to future challenges.

- Maximisation of local manufacturing capabilities: Local manufacturing is a cross-cutting capability that can be expanded to add value to growth sectors. These include pharmaceutical, and food and beverage manufacturing, as well as Australia’s aerospace and defence industries. Current product offerings can be further enhanced to provide additional services, such as incorporating sensors into mining or medical equipment, increasing the features and value of the product to the user.

- Superior componentry: The production and integration of advanced materials will be key to the development of new high-value sectors. Opportunities include specialised components with unconventional and new feedstocks like lightweight materials, carbon fibre, biological materials, pharmaceuticals and the printing of prosthetics, dental and bone implants.

- Sustainable and agile manufacturing: Moving toward closed loop systems with re-cycle, re-use and re-manufacturing principles will enable Australia to offer premium products and reduce reliance on imported critical parts and materials. The ability to use smart and flexible, digitised manufacturing will allow manufacturers to temporarily pivot their production lines to meet short-term supply shortages.

- Value-adding downstream processing of minerals: By adopting advanced processing and refining, Australia can increase the value of minerals before export, producing refined metals, pre-cursor chemicals, alloys and high-end engineered products. This can create high-tech jobs and industries, strengthen supply chains and lower the environmental impact of resources.

Conclusion

In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while funding vaccine development and related science.

In the medium and long term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery.

Disclaimer: This outlook contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.

What is the current macroeconomic environment?

Global economic environment and assistance measures

- COVID-19 is in 216 countries/territories with 25,884,895 confirmed cases and 859,130 confirmed deaths (WHO, 4 September).

- The pandemic has caused a major decline in trade, lower commodity prices and tighter external financing conditions. IMF analysis warns that additional global finance stress could raise risks of contagion, economic scarring and trade tensions. This is particularly the case for economies with pre-existing vulnerabilities, such as those reliant on oil, tourism or remittances, with large current account deficits, high foreign currency debt and limited international reserves (IMF, 4 August).

- Travel restrictions and border closures have greatly affected goods and services trade. For example, global air cargo capacity shrank by 24.6% in March 2020. By the end of April, at least 74 economies had introduced export prohibitions, licences or controls, mostly focussed on medical goods (WTO, 12 August).

- To recap, GDP in the US decreased 9.5% in the second quarter compared with the first (BEA, 30 July) and GDP decreased 11.7% in the EU in the second quarter compared with the first (Eurostat, 14 August).

- Japan's economy shrank 7.8% in the second quarter, its sharpest contraction on record (The Japan Times, 17 August) and the UK economy fell 20.4% quarter on quarter (ONS, 12 August), the largest decline of any major European economy.

Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, the UK at 0.1%.

Despite a growing number of cases, there are signs that countries are now much better prepared to respond to COVID-19, with most countries now having preparedness and response plans and risk communication and community engagement plans in place (WHO, 20 August). However, several countries are experiencing fresh outbreaks after periods of little or no transmission. (WHO, 21 August).

The WHO lists 31 COVID-19 candidate vaccines in clinical evaluation, with another 142 candidate vaccines in preclinical evaluation (WHO, 25 August).

For a comprehensive and current policy response tracker, see IMF, 4 September.

Australian economic environment and assistance measures

26,049 confirmed cases and 678 confirmed deaths (Department of Health, 4 September).

- GDP fell 7.0% in the June quarter, after a fall of 0.3% in the March quarter 2020 (ABS, 2 September). With two consecutive quarters of negative growth, Australia has entered its first technical recession in 29 years.

- State and territory governments continue to impose different restrictions. In Victoria, a COVID-19 outbreak has triggered Stage 4 stay-at-home restrictions for Metropolitan Melbourne with strong restrictions also applied throughout the rest of the state.

- From June to July, the unemployment rate increased by less than 0.1 percentage points to 7.5%. Seasonally adjusted employment increased by 114,700 people and hours worked increased by 1.3% (ABS, 13 August).

- Considering those who have lost employment, left the labour force or have experienced zero working hours, the effective unemployment rate is around 9.9% (Treasurer, 24 August). This is a fall from the peak in April when it reached almost 15% (Treasury, 30 July).

- Retail turnover rose 3.3% in July 2020 from the previous month. Retail turnover rose in all states and territories except Victoria in July (ABS, 21 August).

- Total capital expenditure by private businesses fell -5.9% in the June quarter following a fall of -2.1% in the March quarter (ABS, 27 August).

- Following new restrictions in Victoria, the Government has expanded business access for the JobKeeper extension. This is expected to increase the total cost of the program to $101.3 billion (Treasurer, 7 August).

- The Government will increase aged care support programs with an additional $171.5 million as part of a new COVID-19 response plan agreed by all states and territories (Prime Minister, 21 August).

- The Government has announced a $1 billion investment package to support Australia’s defence industry as part of its COVID-19 economic recovery plans (Prime Minister, 26 August).

The Australian interest rate remains at 0.25%.

How might macroeconomics impact the Australian manufacturing sector?

Manufacturing is a significant contributor to the Australian economy, processing raw materials, supplying intermediate inputs to other sectors, and producing final goods.

In 2019, the sector had a Gross Value Added of $26.1 billion (almost 5.5% of GDP) and employed 890,500 workers. Manufacturing exports totalled $127.1 billion that year.

Expected and observed impacts on the sector

New capital expenditure fell -4.5% for the manufacturing sector in the June quarter, reflecting contractions in new private capital investment caused by country-wide restrictions and record-low business confidence (ABS, 27 August).

Reflecting the ongoing contraction of the economy, the sale of manufacturing goods and services fell 8.6% in the June quarter. Similarly, wages and salaries for the sector fell 3.9% (ABS, 31 August).

In contrast, and reflecting a broader rise in gross company profits, manufacturing company gross operating profits rose 8.4% in the June quarter (ABS, 31 August). This result is largely due to the impact of subsidies.

Manufacturing has been consistently declining as a proportion of the economy (Figure 1.1). This is indicative of a multi-decadal decline for the sector, driven by numerous factors including growth in services, outsourcing and import competition (Productivity Commission, 2003).

Supply chain vulnerabilities and dependencies on overseas manufactured products have been exposed and are being examined (ABC News, 8 June). The Federal Government has stated it is committed to bolstering the local manufacturing sector to secure economic sovereignty (Minister for Industry, Science and Technology, 20 May). One role of the National COVID-19 Commission Advisory Board (NCC) has been to solve immediate supply chain priorities with manufacturers to provide essential products (NCC, 3 April).

However, there has also been much interest in the pivot made by local manufacturing companies to provide essential medical supplies, such as ventilators and PPE, during the initial months of the pandemic in Australia (ABC News, 29 April).

The NCC’s manufacturing taskforce has identified eight industries for growth: food manufacturing, mining technology, defence, renewable energy, healthcare and biotechnology, recycling and packaging, advance manufacturing and aerospace. The taskforce estimates that manufacturing could potentially create

495,000 new jobs in the next decade (SMH, 29 July).

Other commentators have made the case for a 'green recovery', with an accelerated shift to net-zero emissions, led partly by investment in clean-technology exports industries, such as local manufacture of wind turbine and battery components (AFR, 12 August, ABC News, 7 June; The Guardian, 29 June).

CSIRO has launched a missions-led strategy to solve some of Australia's most significant challenges. The agency plans to direct $100 million annually to the co-creation of various missions with government, universities, industry and community partners. Listed among CSIRO's co-creation opportunities are the development of agile manufacturing for higher revenue and sovereign supply, as well as the creation of a hydrogen industry to generate clean energy exports.

Innovation in the sector

The effects of COVID-19 have renewed interest in the sector, highlighting the importance of local manufacturing in times of supply chain fragility and soaring global demand. Innovative manufacturing can generate economic growth opportunities in the medium-term and equip the nation to better respond to future challenges.

- Maximisation of local manufacturing capabilities: Local manufacturing is a cross-cutting capability that can be expanded to add value to growth sectors. These include pharmaceutical, and food and beverage manufacturing, as well as Australia’s aerospace and defence industries. Current product offerings can be further enhanced to provide additional services, such as incorporating sensors into mining or medical equipment, increasing the features and value of the product to the user.

- Superior componentry: The production and integration of advanced materials will be key to the development of new high-value sectors. Opportunities include specialised components with unconventional and new feedstocks like lightweight materials, carbon fibre, biological materials, pharmaceuticals and the printing of prosthetics, dental and bone implants.

CSIRO is helping Textor Technologies adapt their fabric manufacturing technology to make face masks. - Sustainable and agile manufacturing: Moving toward closed loop systems with re-cycle, re-use and re-manufacturing principles will enable Australia to offer premium products and reduce reliance on imported critical parts and materials. The ability to use smart and flexible, digitised manufacturing will allow manufacturers to temporarily pivot their production lines to meet short-term supply shortages.

- Value-adding downstream processing of minerals: By adopting advanced processing and refining, Australia can increase the value of minerals before export, producing refined metals, pre-cursor chemicals, alloys and high-end engineered products. This can create high-tech jobs and industries, strengthen supply chains and lower the environmental impact of resources.

Conclusion

In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while funding vaccine development and related science.

In the medium and long term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery.

For further information

Disclaimer: This outlook contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.