The economy-wide returns to innovation are high. CSIRO Futures has estimated that $1 of R&D investment creates an average of $3.50 in economy-wide benefits in today’s dollars, and a 10% average annual return for Australia.

Science and technology continue to play a critical role in supporting the global response to COVID-19 and will continue to support Australia's economic recovery and long-term resilience.

A scenario analysing the economic implications for Australia under a global delayed transition to net zero emissions is explored in CSIRO's recent Exploring climate risk in Australia [PDF · 4MB] report.

What is the current macroeconomic environment?

Global economic environment

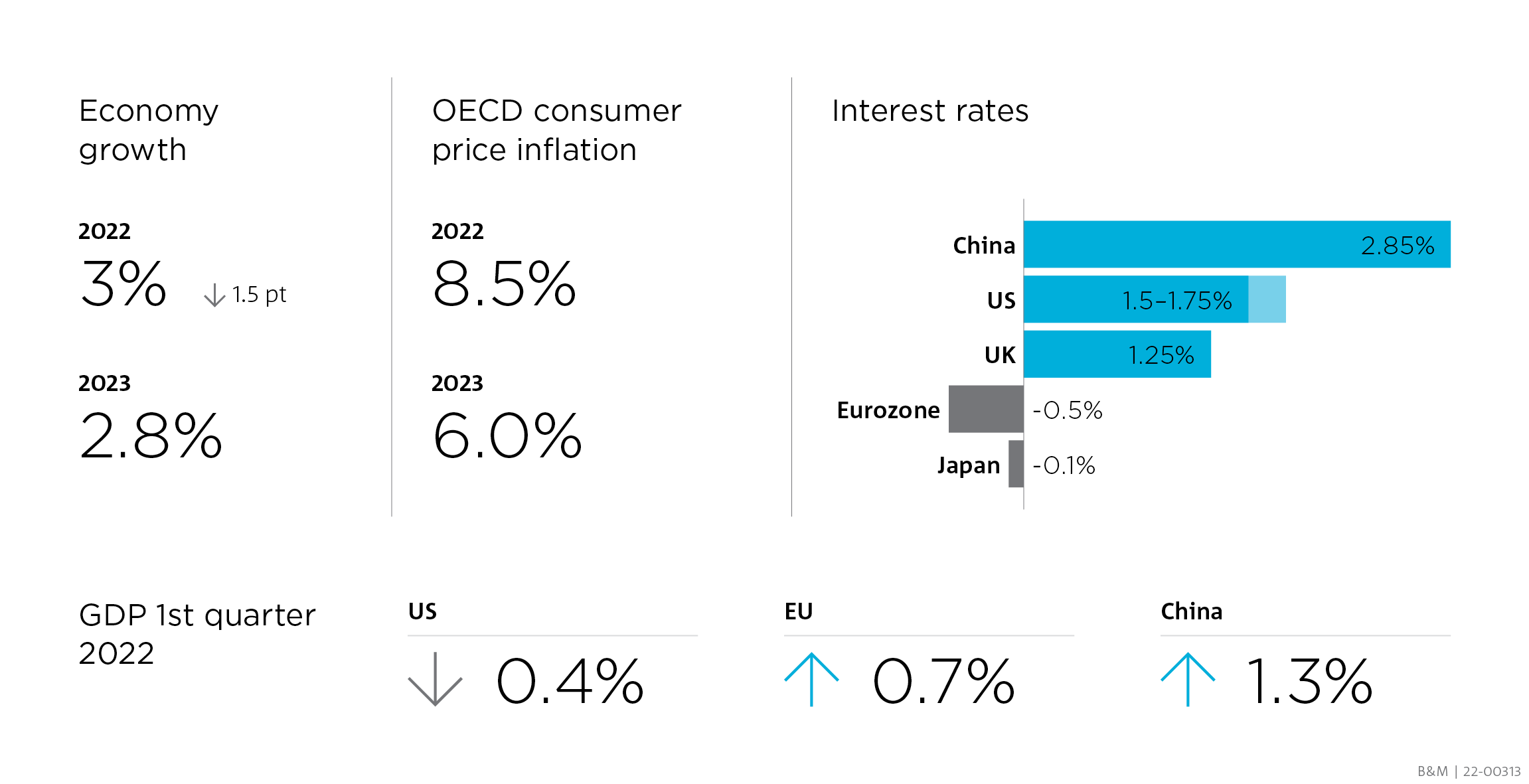

- Global economic growth is forecasted to be 3% in 2022 and 2.8% in 2023, with a downwards revision for 2022 by 1.5 percentage points (pts). This revision is largely due to the war in Ukraine.[1]

- OECD consumer price inflation is projected to average 8.5% in 2022 and 6.0% in 2023. Underlying inflation in many major economies is projected to remain at or above medium-term objectives at the end of 2023.[2]

- Global labour market recovery forecasts have been downgraded for 2022, with hours worked estimated to decline 0.4 pts to 4.2% below pre-pandemic levels in the second quarter of 2022, equivalent to 123 million full-time jobs. This decline is estimated to reflect a notable deterioration for middle income countries, while working hours in high-income countries are recovering this quarter but remain below pre-pandemic levels.[3]

- In the first quarter of 2022:

- Interest rates: Eurozone at –0.5%, China at 2.85%, Japan at –0.1%, the US at 1.5%–1.75%, and the UK at 1.25%.

Global macroeconomic policy measures

- 66.9% of the global population has received at least one dose of a COVID-19 vaccine, although the rollout has fallen considerably short of achieving equitable global distribution.[7]

- Fiscal policy has been mobilised globally to reduce the pass-through of high international energy and food prices to consumers. A recent IMF survey confirms that most countries have introduced at least one fiscal measure this year. Emerging and developing countries typically have continued to rely on price subsidies already in place.[8]

- Monetary policy has been tightening globally in recent months. Between January and April, at least 27 central banks in developing countries increased their policy interest rates, particularly in Latin America and Africa.[9]

Australian economic environment and macroeconomic policy measures

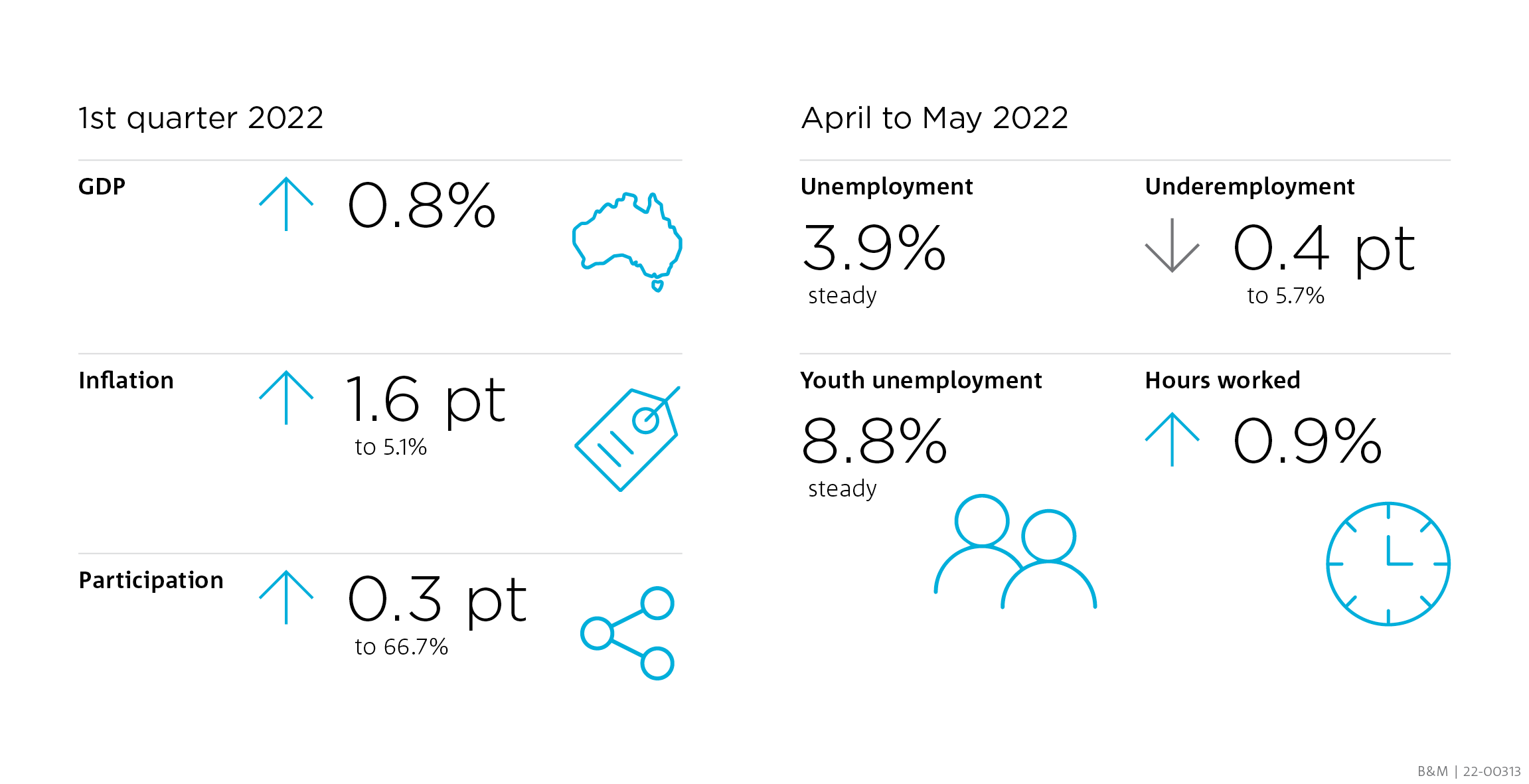

- GDP rose 0.8% in the first quarter of 2022, after increasing 3.6% in the fourth quarter of 2021, with household consumption driving this rise.[10] GDP is forecasted to grow by 4.25% over 2022 and 2% over 2023.[11]

- The annual CPI headline inflation rate increased 1.6 pts to 5.1% in the first quarter of 2022, while the underlying inflation rate increased 1.1 pts to 3.7%.[12] The RBA forecasts the headline rate to reach 7% by the end of 2022.[13]

- The unemployment rate remained at 3.9% from April to May, its lowest point since August 2008, and the participation rate increased 0.3 pts to 66.7%.[14]

- Hours worked increased by 0.9% over the same period.[15] Youth unemployment remained at 8.8% from April to May, which is below pre-pandemic levels, and the underemployment rate decreased by 0.4 pts to 5.7%.[16]

- 70.5% of eligible Australians have received a booster COVID-19 vaccine.[17]

- The RBA interest rate has recently increased for the first time since 2010 to 0.85%, beginning a process of normalising monetary conditions.

- The federal minimum wage will be lifted 5.2% to $21.38 an hour from 1 July to keep up with the cost of living.[18]

- Spending on R&D by higher education organisations decreased 1.4% from 2018 to 2020,[19] and spending on R&D by government increased 8.3% from 2018-19 to 2020-21.[20]

What are the economic implications of Australia’s transition to net zero emissions?

Australia’s national advantages, such as its strength in energy technology research and its world-class energy resources (e.g., solar radiation and critical energy minerals), puts it in a strong position for a net zero transition.

The recently released Exploring climate risk in Australia [PDF · 4MB] report seeks to estimate the economic consequences from climate-related risk through to 2050. These risks can be complex and uncertain in their size, regional scope, and timing, and are hugely dependent on factors such as policy settings, market conditions, and emission profiles.

Specifically, this report explores two global approaches to net zero emissions by 2050 and how they might affect Australia. The first, a ‘Current Policies’ scenario, considers the outcomes that may result from the world undertaking a business-as-usual pathway with the current set of policies and rising global emissions. The second, a ‘Delayed Transition’ scenario, examines the conditions in which the world’s transition to a low carbon economy is postponed until 2030 and before rapid decarbonisation is undertaken.

Insights from the scenario-based analysis

The report reveals a number of crucial differences between the two scenarios, as well as other insights:

- Under the ‘Delayed Transition’ scenario, rapid decarbonisation delivers lower gross state product than under a ‘Current Policies’ scenario in nearly all states and territories, resulting in a lower level of economic production and income.

- A ‘Delayed Transition’ will likely require a high reliance on negative emissions technologies like direct air capture or carbon capture and storage. It should be noted there remain significant challenges in the commercialisation, deployment, and scale-up of these technologies.

- If Australia overly relies on offsets (e.g., sequestration of carbon via vegetation), this could delay its transition to a low carbon economy if the offsets are deployed as a priority over decarbonisation and structural abatement activities.

A summary of Australia’s experience under the two scenarios

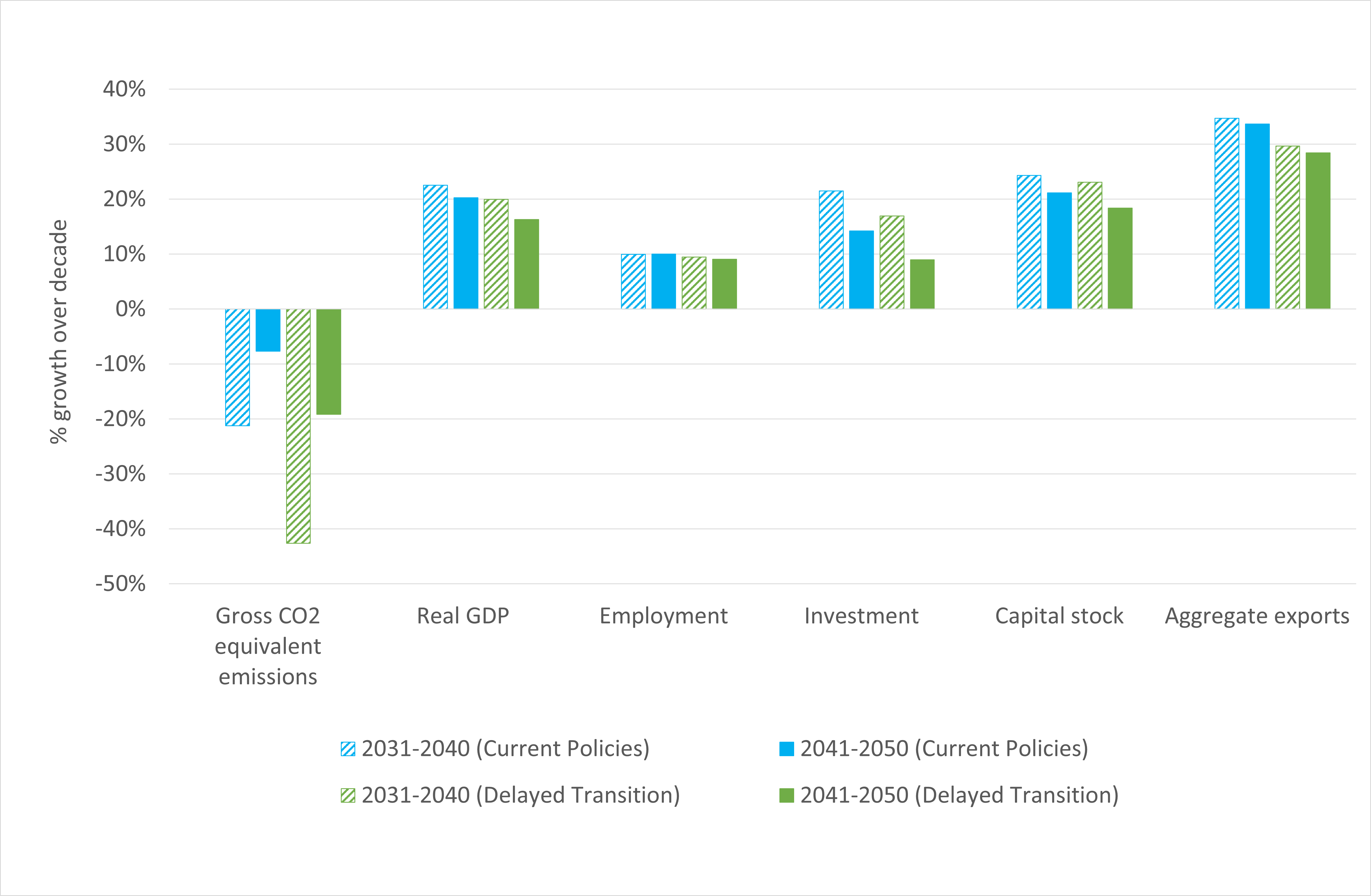

Modelled growth of Australian economic indicators over 2031–40 and 2041–50 for the two scenarios

The chart above summarises key growth differences across the decades (2031–2040 and 2041–2050) for Australia’s economy under the two scenarios. Growth from 2031 onwards under the ‘Current Policies’ scenario is depicted by the blue bars, whereas the ‘Delayed Transition’ scenario is visualised by the green bars.

Some observations based on this chart:

- Emissions: Australia’s CO2 equivalent emissions are reduced at very high rates under the ‘Delayed Transition’ scenario in 2031–2040 (twice as fast as under current policies), reflecting the shorter timeframe needed to cut emissions.

- Real GDP: This sharp and rapid cut in emissions has a noticeable impact on the economy, with GDP growth being markedly weaker from 2031 to 2050 in the ‘Delayed Transition’ scenario. There is 5% GDP per capita difference in 2050 terms between the two scenarios.

- Employment: Similarly, employment participation is somewhat weaker as well over this time period with a decarbonisation delay, although the difference is very slight (a 1% difference in 2050 terms).

- Investment and capital stock: Likewise, investment growth is slower under the ‘Delayed Transition’ scenario (an 8% difference), as is growth in capital stock (a 3% difference).

- Aggregate exports: Aligned with weaker GDP growth, total export growth under a delayed approach also negatively contrasts against the ‘Current Policies’ scenario (an 8% difference). The report notes that mining, agriculture, and manufacturing are particularly impacted.

All in all, the report suggests that a slower, more orderly global transition to a low carbon economy may cost less and improve future material outcomes for Australia.

Australia’s future innovation and resilience

- Short to medium term: focus is on how science and innovation can contribute to economic, social and environmental prosperity, such as through the adoption of deployment-ready technologies.

- Longer term: focus should be on building a resilient economy and reducing Australia’s exposure to future shocks and disruptions. This involves technologies that are in development and demand further investment, technical and commercial testing, and scale-up before their economic potential is realisable.

Notes

- OECD, 8 June

- OECD, 8 June

- ILO, 23 May [PDF · 891KB]

- FRED, 26 May

- Eurostat, 8 June [PDF · 600KB]

- Reuters, 19 April

- Our World in Data, 30 June

- IMF, 7 June

- UN, 3 May

- ABS, 1 June

- RBA, 5 May

- ABS, 27 April

- RBA, 14 June [PDF · 490]

- ABS, 16 June

- ABS, 16 June

- ABS, 16 June

- Department of Health, 29 June

- ABC, 15 June

- ABS, 6 May

- ABS, 15 June

The economy-wide returns to innovation are high. CSIRO Futures has estimated that $1 of R&D investment creates an average of $3.50 in economy-wide benefits in today’s dollars, and a 10% average annual return for Australia.

Science and technology continue to play a critical role in supporting the global response to COVID-19 and will continue to support Australia's economic recovery and long-term resilience.

A scenario analysing the economic implications for Australia under a global delayed transition to net zero emissions is explored in CSIRO's recent Exploring climate risk in Australia [PDF · 4MB] report.

What is the current macroeconomic environment?

Global economic environment

Global economy growth is forecasted to be 3% in 2022 and 2.8% in 2023, with a downwards revision for 2022 by 1.5 percentage points (pts). OECD consumer price inflation is projected to average 8.5% in 2022 and 6.0% in 2023. Underlying inflation in many major economies is projected to remain at or above medium-term objectives at the end of 2023. Interest rates: Eurozone at –0.5%, China at 2.85%, Japan at –0.1%, the US at 1.5%–1.75%, and the UK at 1.25%. In the first quarter of 2022:

- Global economic growth is forecasted to be 3% in 2022 and 2.8% in 2023, with a downwards revision for 2022 by 1.5 percentage points (pts). This revision is largely due to the war in Ukraine.[1]

- OECD consumer price inflation is projected to average 8.5% in 2022 and 6.0% in 2023. Underlying inflation in many major economies is projected to remain at or above medium-term objectives at the end of 2023.[2]

- Global labour market recovery forecasts have been downgraded for 2022, with hours worked estimated to decline 0.4 pts to 4.2% below pre-pandemic levels in the second quarter of 2022, equivalent to 123 million full-time jobs. This decline is estimated to reflect a notable deterioration for middle income countries, while working hours in high-income countries are recovering this quarter but remain below pre-pandemic levels.[3]

- In the first quarter of 2022:

- Interest rates: Eurozone at –0.5%, China at 2.85%, Japan at –0.1%, the US at 1.5%–1.75%, and the UK at 1.25%.

Global macroeconomic policy measures

- 66.9% of the global population has received at least one dose of a COVID-19 vaccine, although the rollout has fallen considerably short of achieving equitable global distribution.[7]

- Fiscal policy has been mobilised globally to reduce the pass-through of high international energy and food prices to consumers. A recent IMF survey confirms that most countries have introduced at least one fiscal measure this year. Emerging and developing countries typically have continued to rely on price subsidies already in place.[8]

- Monetary policy has been tightening globally in recent months. Between January and April, at least 27 central banks in developing countries increased their policy interest rates, particularly in Latin America and Africa.[9]

Australian economic environment and macroeconomic policy measures

Australian economic environment and macroeconomic policy measures

In the first quarter of 2022

From April to May 2022:

- GDP rose 0.8% in the first quarter of 2022, after increasing 3.6% in the fourth quarter of 2021, with household consumption driving this rise.[10] GDP is forecasted to grow by 4.25% over 2022 and 2% over 2023.[11]

- The annual CPI headline inflation rate increased 1.6 pts to 5.1% in the first quarter of 2022, while the underlying inflation rate increased 1.1 pts to 3.7%.[12] The RBA forecasts the headline rate to reach 7% by the end of 2022.[13]

- The unemployment rate remained at 3.9% from April to May, its lowest point since August 2008, and the participation rate increased 0.3 pts to 66.7%.[14]

- Hours worked increased by 0.9% over the same period.[15] Youth unemployment remained at 8.8% from April to May, which is below pre-pandemic levels, and the underemployment rate decreased by 0.4 pts to 5.7%.[16]

- 70.5% of eligible Australians have received a booster COVID-19 vaccine.[17]

- The RBA interest rate has recently increased for the first time since 2010 to 0.85%, beginning a process of normalising monetary conditions.

- The federal minimum wage will be lifted 5.2% to $21.38 an hour from 1 July to keep up with the cost of living.[18]

- Spending on R&D by higher education organisations decreased 1.4% from 2018 to 2020,[19] and spending on R&D by government increased 8.3% from 2018-19 to 2020-21.[20]

What are the economic implications of Australia’s transition to net zero emissions?

Australia’s national advantages, such as its strength in energy technology research and its world-class energy resources (e.g., solar radiation and critical energy minerals), puts it in a strong position for a net zero transition.

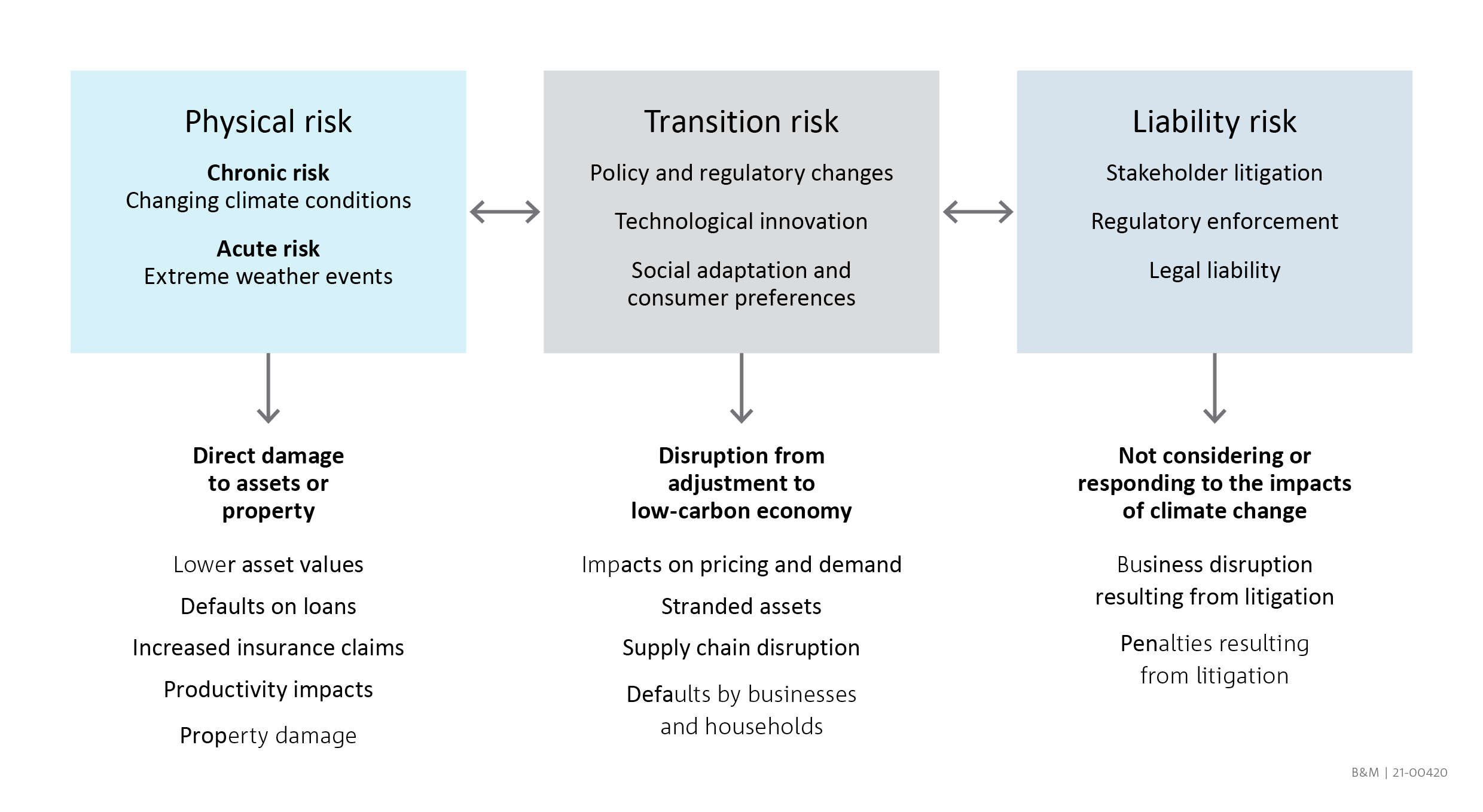

The recently released Exploring climate risk in Australia [PDF · 4MB] report seeks to estimate the economic consequences from climate-related risk through to 2050. These risks can be complex and uncertain in their size, regional scope, and timing, and are hugely dependent on factors such as policy settings, market conditions, and emission profiles.

Transition risks are the potential deterioration in profits and economic development as a result of policy, technological and/or social change. Physical risks are associated with climate hazards such as chronic and systematic gradual changes in the climate or acute extreme weather events. Liability risks are associated with litigation if organisations do not adequately respond to climate change impacts and climate change induced shifts in regulation.

Specifically, this report explores two global approaches to net zero emissions by 2050 and how they might affect Australia. The first, a ‘Current Policies’ scenario, considers the outcomes that may result from the world undertaking a business-as-usual pathway with the current set of policies and rising global emissions. The second, a ‘Delayed Transition’ scenario, examines the conditions in which the world’s transition to a low carbon economy is postponed until 2030 and before rapid decarbonisation is undertaken.

Insights from the scenario-based analysis

The report reveals a number of crucial differences between the two scenarios, as well as other insights:

- Under the ‘Delayed Transition’ scenario, rapid decarbonisation delivers lower gross state product than under a ‘Current Policies’ scenario in nearly all states and territories, resulting in a lower level of economic production and income.

- A ‘Delayed Transition’ will likely require a high reliance on negative emissions technologies like direct air capture or carbon capture and storage. It should be noted there remain significant challenges in the commercialisation, deployment, and scale-up of these technologies.

- If Australia overly relies on offsets (e.g., sequestration of carbon via vegetation), this could delay its transition to a low carbon economy if the offsets are deployed as a priority over decarbonisation and structural abatement activities.

A summary of Australia’s experience under the two scenarios

Modelled growth of Australian economic indicators over 2031–40 and 2041–50 for the two scenarios

Emissions fall approximately twice as much under ‘Delayed Transition’ than ‘Current Policies’. The consequences of having to drive a larger emission cut in a short period of time are reflected in the economic measures. There is a 5% GDP per capita difference in 2050 terms between the two scenarios, a 1% employment, 8% investment, 3% capital stock, and 8% export difference. Differing transition pathways will generate differing pathways – a slower, orderly transition may cost less and improve future economic outcomes.

The chart above summarises key growth differences across the decades (2031–2040 and 2041–2050) for Australia’s economy under the two scenarios. Growth from 2031 onwards under the ‘Current Policies’ scenario is depicted by the blue bars, whereas the ‘Delayed Transition’ scenario is visualised by the green bars.

Some observations based on this chart:

- Emissions: Australia’s CO2 equivalent emissions are reduced at very high rates under the ‘Delayed Transition’ scenario in 2031–2040 (twice as fast as under current policies), reflecting the shorter timeframe needed to cut emissions.

- Real GDP: This sharp and rapid cut in emissions has a noticeable impact on the economy, with GDP growth being markedly weaker from 2031 to 2050 in the ‘Delayed Transition’ scenario. There is 5% GDP per capita difference in 2050 terms between the two scenarios.

- Employment: Similarly, employment participation is somewhat weaker as well over this time period with a decarbonisation delay, although the difference is very slight (a 1% difference in 2050 terms).

- Investment and capital stock: Likewise, investment growth is slower under the ‘Delayed Transition’ scenario (an 8% difference), as is growth in capital stock (a 3% difference).

- Aggregate exports: Aligned with weaker GDP growth, total export growth under a delayed approach also negatively contrasts against the ‘Current Policies’ scenario (an 8% difference). The report notes that mining, agriculture, and manufacturing are particularly impacted.

All in all, the report suggests that a slower, more orderly global transition to a low carbon economy may cost less and improve future material outcomes for Australia.

Australia’s future innovation and resilience

- Short to medium term: focus is on how science and innovation can contribute to economic, social and environmental prosperity, such as through the adoption of deployment-ready technologies.

- Longer term: focus should be on building a resilient economy and reducing Australia’s exposure to future shocks and disruptions. This involves technologies that are in development and demand further investment, technical and commercial testing, and scale-up before their economic potential is realisable.

Notes

- OECD, 8 June

- OECD, 8 June

- ILO, 23 May [PDF · 891KB]

- FRED, 26 May

- Eurostat, 8 June [PDF · 600KB]

- Reuters, 19 April

- Our World in Data, 30 June

- IMF, 7 June

- UN, 3 May

- ABS, 1 June

- RBA, 5 May

- ABS, 27 April

- RBA, 14 June [PDF · 490]

- ABS, 16 June

- ABS, 16 June

- ABS, 16 June

- Department of Health, 29 June

- ABC, 15 June

- ABS, 6 May

- ABS, 15 June